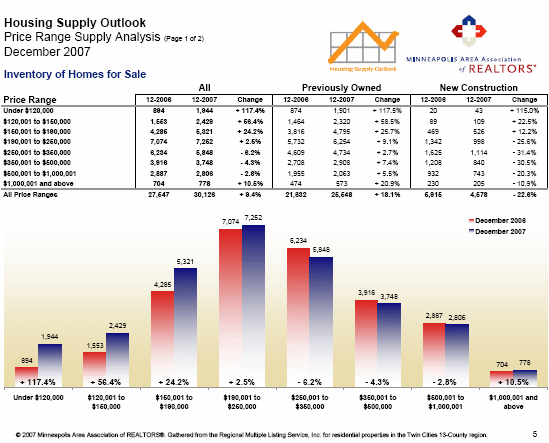

While the Twin Cities Market as a whole in December 2007 had approximately 10% more listings than it did in December 2006, this increase in inventory is substantially skewed towards the 1st time buyer side of the market.

Below you will find slides from the Minneapolis Area Association of REALTORS December 2007 Housing Supply Outlook.

When you look at the numbers, the largest increase in inventory is at the lowest end of the pricing segment. We see that in just 12 months we’ve over doubled the number of homes for sale under $120,000. Even $120,000-$150,000 saw a 56% increase and $150,000-$190,000 saw a 24% increase. When you hit $190,000-$250,000, inventory is only up 2.5% and from $250,000-$1,000,000 inventory has actually shrunk! The 10.5% increase in $1,000,000+ homes is such a small number of units (74) that statistically I don’t think its too significant to the market as a whole.

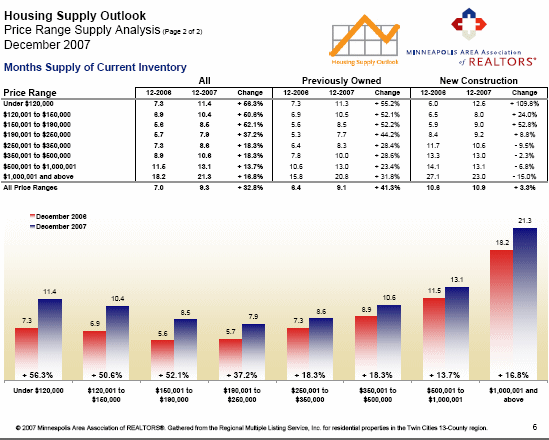

This is a huge contrast! The month of supply has also increased, but not nearly as dramatically, as seen below:

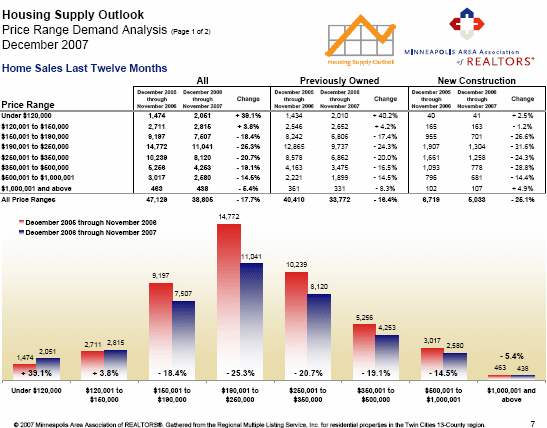

If you look closely at what’s happening in the above charts, you’ll find another trend that’s shown in this chart:

Sales in the last 12 months have grown strongly on the very low end of the market (under $150,000) and have fallen at all higher price points. Metro-wide, sales are down 16%+ so any increase in sales shows a segment clearly bucking the trend.

What does all this mean? Though the subprime market is supposed to have hurt the 1st-time buyer market, the sales from 2007 show that buyers in this range are more active than they were in 2006. Does this mean the 1st time buyer is alive and well??? I’d love to hear comments from the peanut gallery.

One thing I’d love to see is a distribution of homes in foreclosure on this price graph… it would be very interesting to see which price points have the highest foreclosures… are you reading this Jeff Allen?

Daniels Team says

Nice visual stats on your market. Our market seems to be holding up pretty strongly on the $200k and under mark even these days.