If the incessant radio ads from the National Association of REALTORS were not enough, now I see they are also on television with the same garbage: “real estate is a good investment and historically doubles every 10 years.” Give me a break.

There are many, many things that my association does well but this is a prime example of a ridiculous message at a horrible time. I don’t know if there is a single consumer out there today that expects that a house they buy today will double in the next 10 years… and I think most understand that the housing market is not going to move higher for several years.

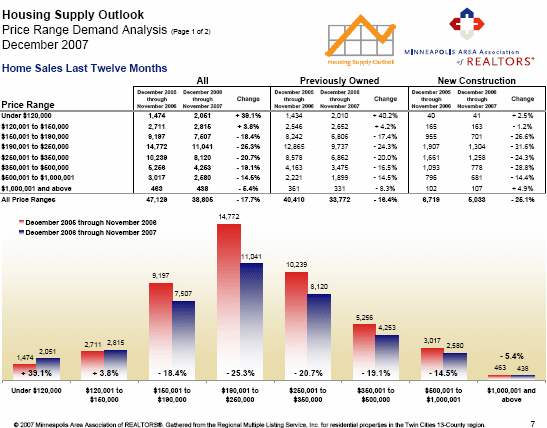

This ad simply promotes the misconception that REALTORS do not understand what is actually happening in the real estate market today, or that we simply will not accept it. When sales are down 30%+ from two years ago (and consequently commissions) and we’re seeing more empty desks and less people in the office, I can assure you that we as agents understand that this is a different market with different needs.

Instead of trying to sell promises of sunshine in the middle of a hurricane, the National Association of REALTORS would be much better off to admit that this market isn’t perfect for everyone, but that there are good opportunities out there for certain people in certain situations.

NAR: Please either promote a more realistic message or shut up entirely… I don’t need the kind of help you’re giving me right now.