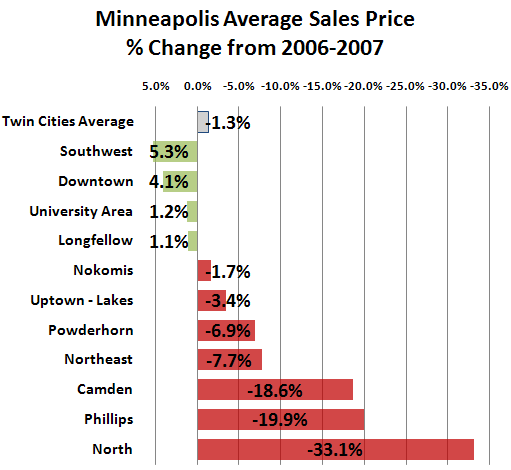

While this housing market has been tough on many communities, parts of Minneapolis are being hit extremely hard. The foreclosure and short sales taking place in Camden, Phillips and North Minneapolis are not only often becoming eyesores in the community, they are also dragging average sales prices down substantially.

Based upon MAAR’s Top 100 report for Minneapolis for December 2007, I was able to construct the following chart of average sales prices in Minneapolis communities:

I wish this chart was wrong, I wish it didn’t show such a disparity amongst neighborhoods, and I wish I didn’t have to talk about it. Alas, not talking about it will not solve the problem and this is an issue I simply could not be silent on any longer.

I have been working on some figures showing the number of homes for sale in these communities that are either in a short sale or foreclosure situation but the data isn’t complete yet and I want to make sure it’s right before I release it. What I can tell you though is that these communities have been hit hard by the rise in short sales and foreclosures, as can be seen by anybody showing houses in these neighborhoods.

While there are still many homes for sale that are owner-occupied and in great condition, the sheer number of distressed properties for sale have a hugely negative effect on the market for the following reasons:

- Competition – Simply having so many homes for sale increases buyer’s options, which puts pricing pressure on sellers.

- Impression – Some homes in a short sale situation and a majority of bank owned properties have been neglected or even boarded up… having a few in a neighborhood brings down the perceived character of the neighborhood.

- Comparables – Eventually these distressed properties sell and then become comparables for appraisers and future buyers. Though the condition may be terrible, that isn’t readily apparent in most MLS reports and therefore the appraiser or buyer may believe the home was in better condition that it actually was, thus pulling down the value of homes it is compared against.

As we are still in the middle of the subprime and ARM mortgage fallout, the high inventory and pricing pressure in theses neighborhoods is not likely to moderate for quite some time, which could lead to further price erosion this year.

While this is terrible news for the current homeowners in these neighborhoods, there is supposed to be a “silver lining” to this market downturn: housing affordability in these neighborhoods has headed substantially higher in the last year to the point that many people who could not afford to buy a home years ago can get into a home today.

I just recently closed on a deal with a 1st time buyer who purchased a 3 bedroom, 1 bathroom home with 1 car attached garage just a few blocks off the Parkway in North Minneapolis. This home had quite a few cosmetic issues to fix but had a new furnace and newer roof and some great built-ins and woodwork. Her total payment is under what she was paying in rent and her home has a lot more space for her family!

While she was successful, it was a big struggle to get her into the home, mainly because of the catch-22 on the only loan we were able to get for her:

- Like most 1st time buyers, she had little cash upfront.

- 100% financing is almost completely gone, so the next best thing is FHA financing, with a 3% downpayment requirement and upfront Mortgage Insurance Premium.

- This buyer was able to secure some downpayment assistance money and we had the seller pay the closing costs, so her total out of pocket cash to close was approximately $1000.

- To meet FHA guidelines, the home had to be livable at closing. This means the plumbing, electrical and heating all had to be in working condition and operating for the appraiser’s inspection.

- Like a large number of homes that are bank-owned, the utilities were off when we saw it, but we were able to get the seller(bank) to agree to dewinterize and turn on the heating and water.

- There were items that needed repairs to get it to pass the FHA appraisal and most banks do not permit a buyer to complete any work on the property prior to close, but we were able to secure permission from the listing broker to make minor repairs.

- When the water was turned on we found out that that the water heater was broken and we had to have a plumber install a new one, which was an unexpected expense.

- There was exterior paint on the foundation that was peeling (an FHA issue) but since it was too cold to fix it the money had to be set aside at closing for the repairs.

While this buyer was able to get into this home, most other first time buyers will not be as lucky. As I said above, most banks will not let anyone do anything to repair the home prior to closing and so if the home is out of FHA compliance for almost anything, the buyer will not be able to purchase that home. Homes that are in a short-sale position are typically in better condition and sellers would work with a buyer on repairs but if it is anything costly no one will have any money to fix it!

The other issue is the 3% downpayment… many buyers simply do not have that saved, but are more than capable of making the monthly payments. There are some downpayment assistance programs available but they are a small share of the total market and many loan officers are either unaware of them or in the case of government-sponsored programs, are not approved to use them. This will put many of the rest of the homes that are in good condition still out of reach.

If a 1st time buyer does have cash, they can go with a Conventional loan & eliminate most of the lender required repairs but most of those loans need a minimum of 5% down payment and if the appraiser or Fannie Mae or Freddie Mac describe the neighborhood as a “declining market,” then the down payment requirement would jump from 5% to 10% for most and the zero down payment loans would go to 5%.

What this all means is that only a limited number of 1st time buyers will be able to take advantage of this “silver lining.” The rest of this inventory will need to be acquired by buyers who have significant cash: typically rehabbers and landlords. Rehabbers are likely to remain on the sidelines for a while longer simply because the fundamentals of the market in these areas are still softening and that makes it risky to go in and try to fix it up and sell it for a profit.

That really leaves us with landlords. As with my buyer, these landlords can come in and buy these homes for less than their rental value and make great cash flow off them. While that will mean the neglected exteriors of many of these houses will likely get some attention, it could take largely owner-occupied neighborhoods to largely rental neighborhoods and I believe that most people would agree that strong neighborhoods are those that have a good balance between owner-occupied and rental.

This situation needs immediate attention by the community. In the best of circumstances, a public-private partnership would be formed to help assist more 1st time buyers in acquiring these affordable homes and try to help keep these communities occupied and maintain the balance between owner-occupied and rental. This assistance could be in the form of additional downpayment assistance or nonprofit rehabbers turning around and selling it to eligible buyers. Either way this takes money that doesn’t appear to be just sitting around, so this will take a considerable effort to achieve.