A debate recently in my office between another agent and I focused on whether foreclosures and short sale properties really should be used for comparables for “normal” sales.

My esteemed colleague believes that since foreclosures and short sales are sold under “distressed” situations, they are not good comparables for other homes for sale. My counter is that many foreclosures and short sale properties are not in bad condition and so they should sell at a fair market price regardless of their “distressed” situation.

When it comes down to it, foreclosure and short sale listings most often do sell at a discount to regular listings and should have that taken into consideration, but even in a slow market houses priced appropriately are selling quickly, so those are market prices.

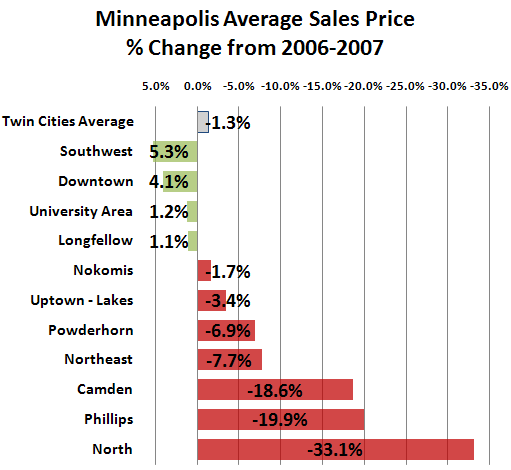

What we do find is a substantial disparity on how much of an impact those foreclosures have on the houses around them. In areas with low numbers of foreclosure and short sale properties, we find that those properties have little effect on the market as a whole. Where there are a high number of these properties in a single area, we find the the impact is more like an exponential impact: the higher the number, the more substantial the impact each additional listing has.