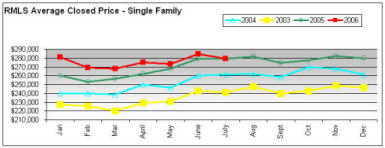

January 1st 2007 marked the low point for Active Listings in the market for at least the next 10-11 months. As is typical for our market, new listings will hit the market in ever-increasing numbers each week and will add to our supply of Active listings until sometime this summer, when the number of listings will likely peak for the year. In fact, since the 1st of the year the number of listings in the Twin Cities has gone up by over 2000!

While the number of listings in the market will rise dramatically, this is also the time when we see the largest increase in buyer activity as well. Last year from January to May we saw supply increase in lock-step with demand such that the ratio of buyers to sellers remained relatively flat until summer. If trends remain the same this year we should see the same pattern which means more choice for buyers but also quicker turnover of what is listed for sale.