Welcome to the June 1, 2009 edition of carnival of real estate.

A lot of people like reading Top 10 lists and I was intending to do a Top 10 list, however this week I didn’t feel like there were 10 submissions worth sharing with you all so here is my:

Top 9 Post Submissions

#1 – Reminding us that real estate is always local and showing us why

Tallahassee Real Estate presents Killearn Lakes Unit 1 Home Prices Holding posted at Tallahassee Real Estate Blog, saying, “A classic example of why most real estate reports are flawed. They lead you to believe that prices are going up or prices are going down, solely based upon the movement of the average sales price. This article shows why it is possible for the average home price to go up, while real home values are dropping.”

#2 – A variation on the same theme

Danilo Bogdnaovic presents Best Condo Investment Opportunities in Loudoun, Fairfax County posted at Loudoun Foreclosures, saying, “Though this post is hyper-local, the reasoning/logic behind it holds true throughout the US and should be considered by all agents and real estate investors (imho).”

#3 – Multiple offers are everywhere today (at least in my market) and we all need to bone up on our sales skills

Dan Melson presents I’m Competing Against Multiple Offers. How Do I Proceed? posted at Searchlight Crusade.

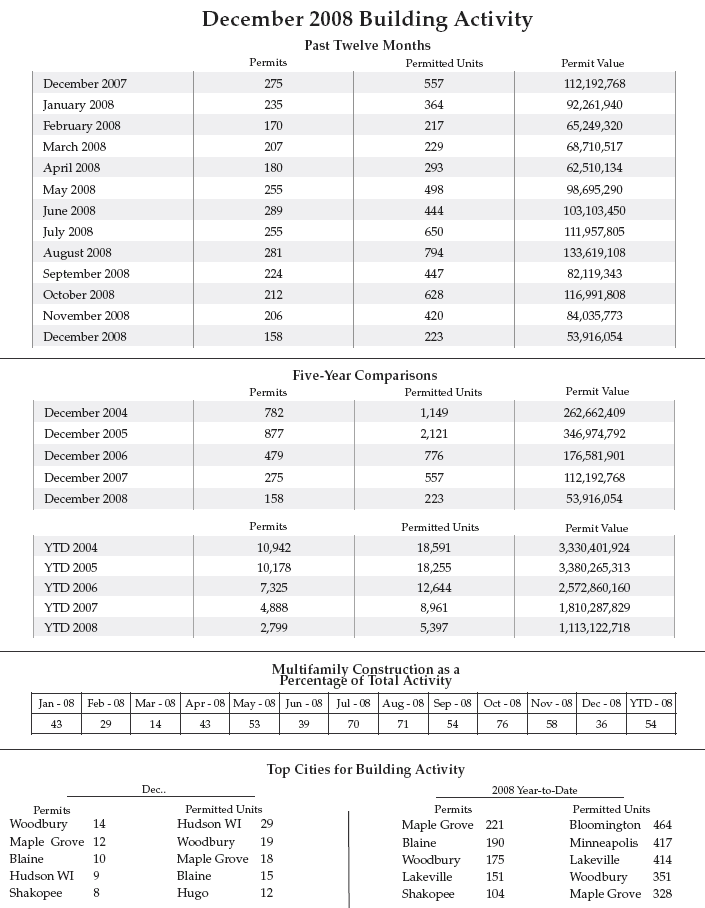

#4 – I too have many objections to Case-Shiller… check out my association’s data for some examples of better info: 1, 2, 3, 4, 5

Dan Green presents Why The March 2009 Case-Shiller Home Price Index Is Good News For Housing posted at The Mortgage Reports, saying, “To economists, the Case-Shiller Index is helpful. To homeowners, it’s almost worthless.”

#5 – Foreclosures impact many families… each house foreclosed means a family affected

Donna Johnston presents “Mommie are we going to have to move?” posted at Talk Charlotte Real Estate Blog, saying, “This hits me right in my heart.”

#6 – This is a little bit of a “duh” post but hey…

Jim Reppond presents What social networks are agents marketing on? posted at The Seattle Specialist, saying, “Internal Top Producer poll that suggests most agents are now using social media to promote their listings – especially Facebook.”

#7 – MI is deductible but sometimes there are better options

NetBiz presents How To Avoid Paying PMI (Private Mortgage Insurance) posted at Your Finish Rich Plan, saying, “List of ways you can void paying for PMI, thus lowering your monthly mortgage payments”

#8 – Green building is increasing in my market, how about yours?

Mark Donovan presents Definition Green Building Product posted at HomeAdditionPlus, saying, “Green home building is a phrase that is often overused and misunderstood. In this article Mark Donovan discusses the process of assessing whether or not a green home building product is truly green for your particular green custom home building project.”

#9 – There’s a sucker refinanced every minute…

nickel presents Beware the “No-Cost” Mortgage Refinance posted at fivecentnickel.com.

That concludes this edition. Submit your blog article to the next edition of carnival of real estate using our carnival submission form. Past posts and future hosts can be found on our blog carnival index page.

Technorati tags: carnival of real estate, blog carnival.