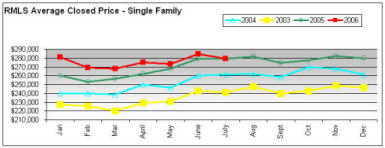

As we near Fall in the Twin Cities, we’ve now entered a new stage in the housing market we have not seen for many years: the Average Selling Price is now unchanged from last year at this time.

In recent years we have seen a large runup in Average Sales Price during the spring and summer months. This year was marked by much smaller gains, which has lead to us “catching up” with last year’s price. While this means that sellers cannot expect any appreciation in their home over last year, it also means for sellers that are moving up that their future home will not cost as much as they expected.

This is not a sign of a bursting bubble, this is only a continued ease in the housing market that is bringing more historically common market times and appreciation back into the market. We’ve been cooling off for several years now and this has sharply reduce the chances for a dramatic price drop.