Leave it to a loan officer to give the best explanation for why buyers may want to consider a purchase right now: http://www.themortgagereports.com/2008/03/stop-asking-you.html

Leave it to a loan officer to give the best explanation for why buyers may want to consider a purchase right now: http://www.themortgagereports.com/2008/03/stop-asking-you.html

I’ve got a poll running regarding the number of short sales and foreclosures on the MLS on my other blog that I’d like to see responses to. Please go over and visit and submit your opinion!

Today I received a call from a reader that wanted to first and foremost commend me for my blog, but also had a couple questions to ask. It’s great to get calls or emails from readers (there’s a lot of you out there!) and I’m always happy to answer questions as well.

If you need something, do not hesitate to call or email me.

Edina Realty has just kicked off their 2008 advertising campaign and has some very funny commercials they are running in Minnesota but also posted to YouTube… take a look:

Nerd & Model:

Biker & Mom:

Grandma & HipHop:

Hunter & Yoga Gal:

Nerd & Model Outtake 1:

Nerd & Model Outtake 2:

A debate recently in my office between another agent and I focused on whether foreclosures and short sale properties really should be used for comparables for “normal” sales.

My esteemed colleague believes that since foreclosures and short sales are sold under “distressed” situations, they are not good comparables for other homes for sale. My counter is that many foreclosures and short sale properties are not in bad condition and so they should sell at a fair market price regardless of their “distressed” situation.

When it comes down to it, foreclosure and short sale listings most often do sell at a discount to regular listings and should have that taken into consideration, but even in a slow market houses priced appropriately are selling quickly, so those are market prices.

What we do find is a substantial disparity on how much of an impact those foreclosures have on the houses around them. In areas with low numbers of foreclosure and short sale properties, we find that those properties have little effect on the market as a whole. Where there are a high number of these properties in a single area, we find the the impact is more like an exponential impact: the higher the number, the more substantial the impact each additional listing has.

If the incessant radio ads from the National Association of REALTORS were not enough, now I see they are also on television with the same garbage: “real estate is a good investment and historically doubles every 10 years.” Give me a break.

There are many, many things that my association does well but this is a prime example of a ridiculous message at a horrible time. I don’t know if there is a single consumer out there today that expects that a house they buy today will double in the next 10 years… and I think most understand that the housing market is not going to move higher for several years.

This ad simply promotes the misconception that REALTORS do not understand what is actually happening in the real estate market today, or that we simply will not accept it. When sales are down 30%+ from two years ago (and consequently commissions) and we’re seeing more empty desks and less people in the office, I can assure you that we as agents understand that this is a different market with different needs.

Instead of trying to sell promises of sunshine in the middle of a hurricane, the National Association of REALTORS would be much better off to admit that this market isn’t perfect for everyone, but that there are good opportunities out there for certain people in certain situations.

NAR: Please either promote a more realistic message or shut up entirely… I don’t need the kind of help you’re giving me right now.

The Parade of Homes started last weekend and continues through March 16, 2008. This is typically a time where we see a uptick in buyer activity and in the past, builders have used this as a platform to push some of their “spec” homes and of course push their custom homes as well.

While it certainly seems inviting for buyers to go to these model homes on their own, doing so means they miss their opportunity to get fair and impartial information from an agent representing their best interests. Some homes on the Parade are a good value, some are not. Each builder, location, and style/model of home has its good and its bad, and a knowledgeable agent can provide great advice on the available options.

Many buyers think that they can go see the houses on their own and then bring an agent back to help them with the one they want to purchase. While that is true, what the buyer probably doesn’t know is that their agent may or may not be compensated by the builder for the sale because of Procuring Cause.

Simply put, buyers that want to have an agent represent them in a transaction should coordinate all their showing activities through that agent.

If you look at both the weekly MAAR report and the January Monthly Indicators you will see that the market is slipping more substantially in January this year vs. previous years.

I personally see this as a positive as the current capitulation in the market will hopefully mean a quicker trek to the bottom and should help drive buyers waiting on the sidelines back into this market. I also feel like these stats finally show what I think many people have felt out in the market for quite some time…

With the HAI hitting 149 & a historical average in the mid-150’s (RREAR Page 2 and January Monthly Indicators Page 12), we’re getting awfully close to historical affordability levels.

Due to our seasonal nature in Minnesota real estate I still think we won’t see a bottom until Q4 2008 but the acceleration downward makes it seem more possible that this market will find its bottom in 2008 and not limp slowly down the hill for years to come. Add to that the plan the 6 banks are putting forward to renegotiate loans already in default and I sense that this market is finally starting to make steps that will lead to a definite bottom in the future.

It’s impossible to time the market bottom and with interest rates still near all-time lows it isn’t a bad time to make a move up to a more expensive home or to buy a first home. Prices may fall further but if interest rates move higher on inflation fears, any additional decrease in sales prices may be erased by equivalent or greater increases in interest rates.

If you’re wondering if now is a good time to buy for your situation, feel free to call or email me to discuss your situation.

A client of mine found information via MNDOT regarding the traffic levels of train tracks throughout Minnesota, including the Twin Cities. Unfortunately it does not show the train times but it does give an approximate count of the number of trains per day and the speed at which they travel: http://www.dot.state.mn.us/ofrw/freightData.html

Pretty cool information… thanks Lisa & Jason!

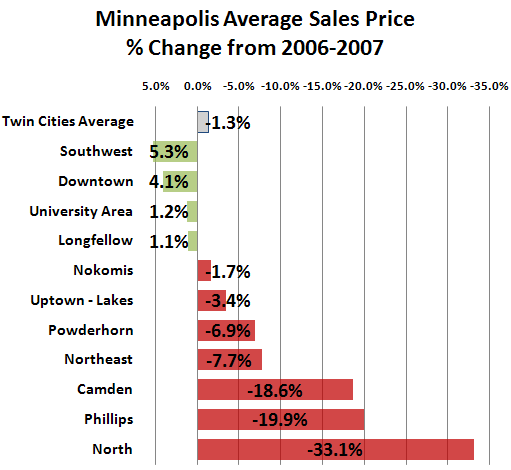

While this housing market has been tough on many communities, parts of Minneapolis are being hit extremely hard. The foreclosure and short sales taking place in Camden, Phillips and North Minneapolis are not only often becoming eyesores in the community, they are also dragging average sales prices down substantially.

Based upon MAAR’s Top 100 report for Minneapolis for December 2007, I was able to construct the following chart of average sales prices in Minneapolis communities:

I wish this chart was wrong, I wish it didn’t show such a disparity amongst neighborhoods, and I wish I didn’t have to talk about it. Alas, not talking about it will not solve the problem and this is an issue I simply could not be silent on any longer.

I have been working on some figures showing the number of homes for sale in these communities that are either in a short sale or foreclosure situation but the data isn’t complete yet and I want to make sure it’s right before I release it. What I can tell you though is that these communities have been hit hard by the rise in short sales and foreclosures, as can be seen by anybody showing houses in these neighborhoods.

While there are still many homes for sale that are owner-occupied and in great condition, the sheer number of distressed properties for sale have a hugely negative effect on the market for the following reasons:

As we are still in the middle of the subprime and ARM mortgage fallout, the high inventory and pricing pressure in theses neighborhoods is not likely to moderate for quite some time, which could lead to further price erosion this year.

While this is terrible news for the current homeowners in these neighborhoods, there is supposed to be a “silver lining” to this market downturn: housing affordability in these neighborhoods has headed substantially higher in the last year to the point that many people who could not afford to buy a home years ago can get into a home today.

I just recently closed on a deal with a 1st time buyer who purchased a 3 bedroom, 1 bathroom home with 1 car attached garage just a few blocks off the Parkway in North Minneapolis. This home had quite a few cosmetic issues to fix but had a new furnace and newer roof and some great built-ins and woodwork. Her total payment is under what she was paying in rent and her home has a lot more space for her family!

While she was successful, it was a big struggle to get her into the home, mainly because of the catch-22 on the only loan we were able to get for her:

While this buyer was able to get into this home, most other first time buyers will not be as lucky. As I said above, most banks will not let anyone do anything to repair the home prior to closing and so if the home is out of FHA compliance for almost anything, the buyer will not be able to purchase that home. Homes that are in a short-sale position are typically in better condition and sellers would work with a buyer on repairs but if it is anything costly no one will have any money to fix it!

The other issue is the 3% downpayment… many buyers simply do not have that saved, but are more than capable of making the monthly payments. There are some downpayment assistance programs available but they are a small share of the total market and many loan officers are either unaware of them or in the case of government-sponsored programs, are not approved to use them. This will put many of the rest of the homes that are in good condition still out of reach.

If a 1st time buyer does have cash, they can go with a Conventional loan & eliminate most of the lender required repairs but most of those loans need a minimum of 5% down payment and if the appraiser or Fannie Mae or Freddie Mac describe the neighborhood as a “declining market,” then the down payment requirement would jump from 5% to 10% for most and the zero down payment loans would go to 5%.

What this all means is that only a limited number of 1st time buyers will be able to take advantage of this “silver lining.” The rest of this inventory will need to be acquired by buyers who have significant cash: typically rehabbers and landlords. Rehabbers are likely to remain on the sidelines for a while longer simply because the fundamentals of the market in these areas are still softening and that makes it risky to go in and try to fix it up and sell it for a profit.

That really leaves us with landlords. As with my buyer, these landlords can come in and buy these homes for less than their rental value and make great cash flow off them. While that will mean the neglected exteriors of many of these houses will likely get some attention, it could take largely owner-occupied neighborhoods to largely rental neighborhoods and I believe that most people would agree that strong neighborhoods are those that have a good balance between owner-occupied and rental.

This situation needs immediate attention by the community. In the best of circumstances, a public-private partnership would be formed to help assist more 1st time buyers in acquiring these affordable homes and try to help keep these communities occupied and maintain the balance between owner-occupied and rental. This assistance could be in the form of additional downpayment assistance or nonprofit rehabbers turning around and selling it to eligible buyers. Either way this takes money that doesn’t appear to be just sitting around, so this will take a considerable effort to achieve.